What Are the Different Types of Letter of Credit?

In our earlier article, we discussed what a letter of credit means, the parties involved, and the process of obtaining one. We will summarize the earlier article here before discussing the types of letters of credit.

A letter of credit (LC) is a financial instrument that a buyer requests and gets from their bank to provide a guarantee of payment to the seller. The LC also details the terms and conditions the seller must meet to get the payment. As you know LC can also help you get financing through bill discounting by providing documentary support.

Letters of credit play a significant role in export transactions and when the exporters accept international payments. They assure that the seller is obligated to meet the quality standards, specifications, and delivery time. Through the LC, the buyer guarantees payment to the seller once the transaction is completed. Moreover, it helps with post-shipment finance.

Now that we understand the letter of credit and its role in inward remittance let’s examine the various types of letters of credit.

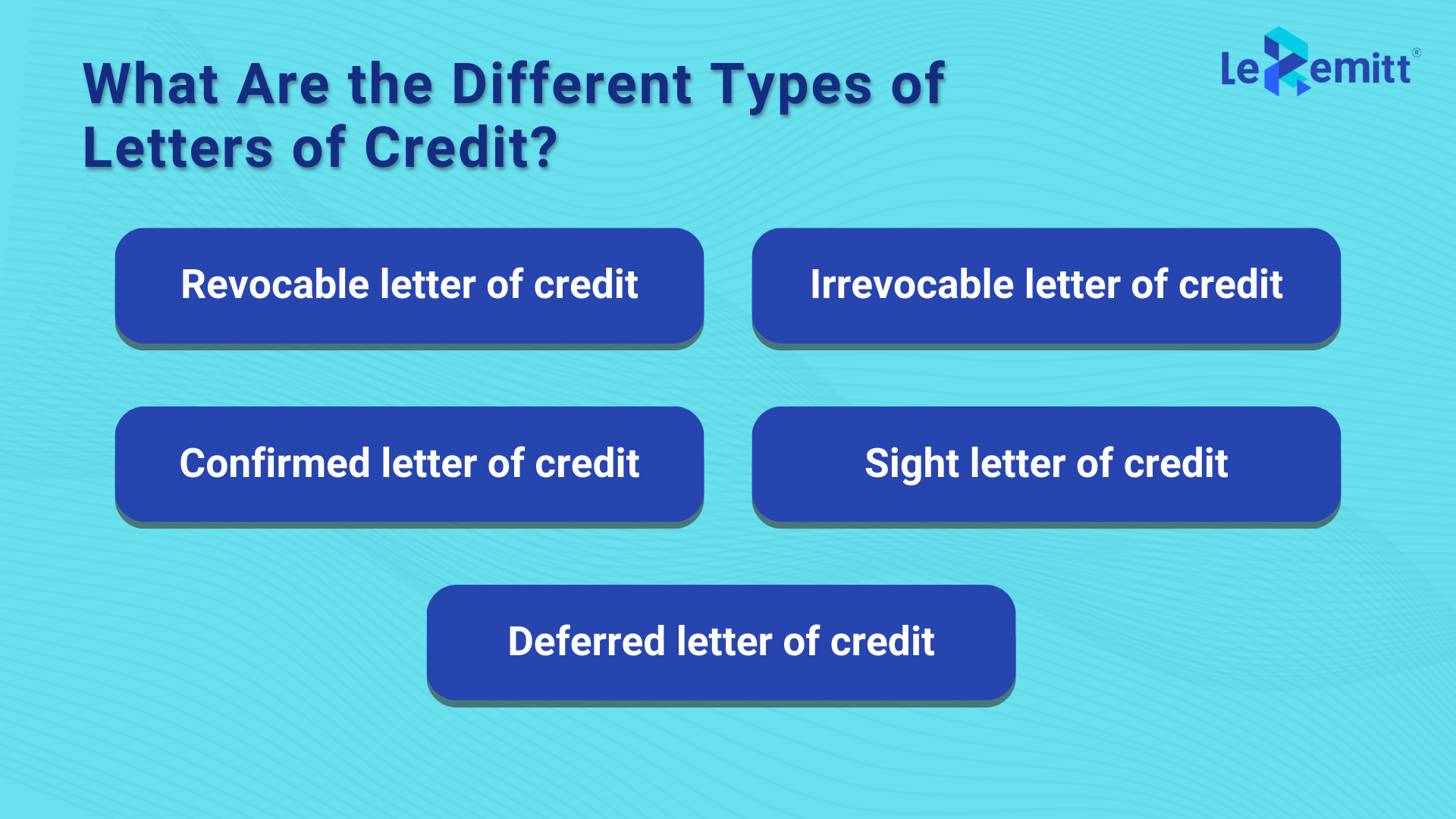

What are the different types of letters of credit?

Let’s examine the different types of letters of credit so that you can make the right decision when you undertake an export transaction.

Revocable letter of credit:

This type of LC can be revoked or altered by the buyer or the bank that issues it without the seller's consent. In most instances, the seller may not want to use this type of LC due to the uncertainty associated with this financial instrument.

Irrevocable letter of credit:

As the name suggests, this LC is an agreement that cannot be revoked unless both parties explicitly agree to the LC being revoked. Since this type of LC assures the seller, it is preferred over the irrevocable LC.

Confirmed letter of credit:

This is an LC that comes with an additional guarantee from another bank (other than the issuing bank), most often from the seller’s country, that the payment will be fulfilled even if the issuing bank fails to meet the payment obligation.

Sight letter of credit:

This type of LC ensures the payment is made as soon as the seller presents all the transaction-related documents. The payment will be made once the documents are validated and found to be compliant.

Deferred letter of credit:

This form of LC guarantees that the payment will be made and that it will be completed on the future date specified in the LC. Payment is guaranteed only upon completion of the transaction and once the documents are provided.

What are the common uses of letters of credit?

Letters of credit are financial instruments often used when the transaction is across borders and the seller wants a mechanism that guarantees payment. They can also be used when the transaction is large and complicated, where the specifications are complex and the transaction amount is bigger. In the same way, sellers and buyers prefer an LC when there is a complex transaction with multiple steps involved. Though we covered the process for obtaining an LC in the earlier article, we will now examine the additional nuances of export trade.

The process starts with an agreement between the exporter (seller) and the importer (buyer) on the specifications, rates, delivery dates, payment terms, and other related details. The importer requests an LC be issued from their bank. The LC has all the terms for the transaction and outlines the documents required for payment, shipment dates, and other details.

The issuing bank sends the LC to the advising bank, which notifies the exporter about the terms outlined in the LC. The exporter accepts the terms, ships the goods, and collates the related documents (commercial invoice, bill of lading, etc.). The seller verifies the documents and presents them to the advising bank.

The advising bank sends the documents to the issuing bank, which checks and validates the documents and releases payment to the exporter as per the terms of LC. If it’s a deferred LC, then the payment will be made on the specified date. Once the payment is released, the issuing bank hands over the documents to the buyer who can take the delivery of the goods.

At LeRemitt, we help you with one of the most crucial steps in the export process—the inward remittance stage. We ensure the process is quick, transparent, and compliant with regulations. Want to learn more? Connect with us!