Learn about Bill Discounting (Invoice Discounting) and Its Process

Bill discounting or discounting accounts receivables to access immediate cash and resolve some of your cash flow issues. Let’s break this into a few simple steps to understand what is bill discounting from an exporter’s point of view.

You have received an invoice or bill for the goods or services provided, stating details like the goods sold, the price per unit, the total amount, and the date you will receive the payment. However, your business has received a huge order that you need to execute within a short time, and you need an influx of capital to make this happen. We all know that receiving international payments to finance your operations may not happen on time.

You can use your cross-border trade documents to start the process. You take the due bill and ask a financial institution to use it as leverage to get finance. The bank or financial institution will examine the details of the bill, determine its authenticity, evaluate your financial status and that of the buyer, and discount the bill. The invoice amount evaluation can vary between 70% and 90% of the bill amount. This amount will be paid to the seller seeking the bill discounting facility after deducting a fee.

For instance, if the bill amount is $1000, it will be evaluated between $700 and $900, and you can get this amount after fees are deducted. When the invoice becomes due for payment, the buyer will pay the complete bill amount (in this case, $1000) to the financial institution. If the buyer fails to pay the invoice, the financial institution will seek repayment from the seller who asked for the bill discounting facility.

● Also read: What is FIRC (Foreign Inward Remittance Certificate)?

As an exporter, you may have several questions about bill discounting. We will try to answer each one in the order they occur.

What is bill discounting?

Bill discounting is a process for obtaining short-term finance using your receivables as collateral. To obtain quick finance, you must settle for slightly less than the bill amount due and pay a fee.

What does rebate on bill discounted mean?

The rebate on bill discounting is the percentage at which the bill amount is evaluated. For example, if you have a bill for $1000 and the financial institution is willing to provide you $850, then the rebate is 15%.

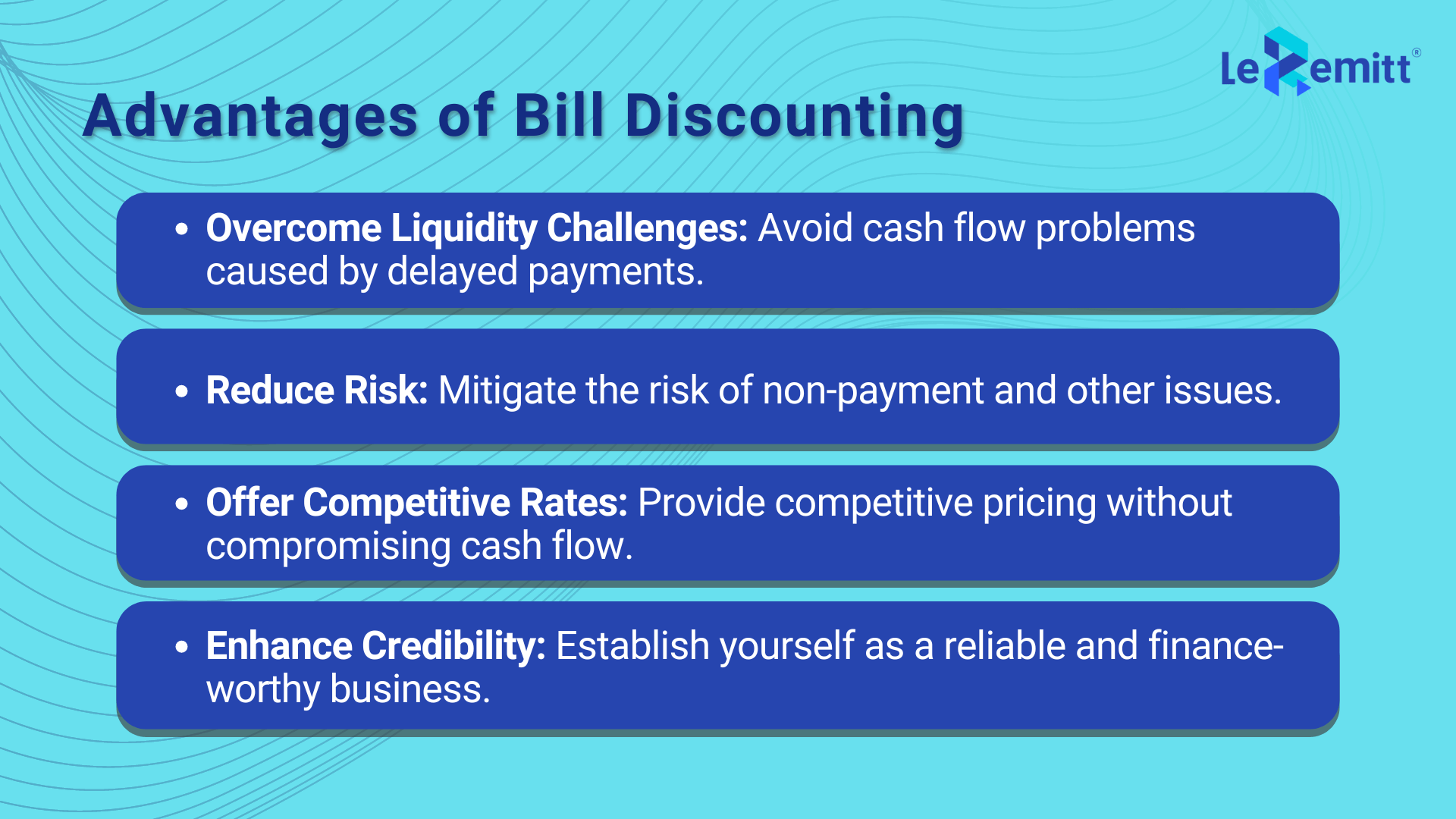

What are the advantages of bill discounting?

Bill discounting may seem like an expensive financing option when you initially consider it. Still, as an exporter, you know the value of quick and easy options to keep your business running, and bill discounting is just that.

Here are some of the main advantages of bill discounting:

1. Liquidity: As an exporter, balancing your order book and meeting high international standards can be challenging. One significant challenge is delayed payments, as you have to offer generous credit terms to bag orders. Bill discounting helps ensure that you do not face liquidity issues by providing you with quick finance options within FEMA guidelines.

2. Reduced risk: When you sell goods or services on credit, you always face risks like non-payment, partial payment, or other issues. Bill discounting can pad this risk a bit by ensuring that a few missed payments do not affect your cash flow and, thereby, your business.

3. Competitive rates: Many businesses hesitate to offer competitive rates because they fear this will affect their cash flow. But when you have a bill discounting facility with your bank, you can be generous in pricing your goods or services.

4. Credibility: By availing yourself of bill discounting with your bank and adhering to the transaction terms, you establish yourself as a credible business worthy of financing. You can explore other financing options with the same bank or financial institution.

What is the bill discounting process, and what are the eligibility criteria for bill discounting?

1. Bill issuance: The buyer issues a bill or invoice confirming the payment terms, specifying the due amount and date.

Requesting bill discounting facility: This bill is presented to the financial institution requesting the bill discounting facility.

2. Verification and evaluation: The financial institution will validate and verify if the bill is genuine and then evaluate the seller and buyer’s financial credibility.

3. Discounting the bill: The financial institution will discuss the terms it can offer for bill discounting. If both parties agree, the financial institution or bank will provide the discounted amount to the seller.

4. Collection and settlement: Once the bill comes due, the financial institution will seek payment from the buyer. In case of default, it will take steps to settle the account by seeking recourse from the seller.

We hope that you found the above information helpful. At LeRemitt, we strive to provide services and information that will help make your business operations seamless. Want to learn more about our services? Get in touch with our team!